Ookitspoomowaw

"We are here to help"

Admissions

Ali Smith

Admissions Director

Joshlynn Snow

Dual Enrollment and Transfer Coordinator

Sequoia Reevis

Enrollment Specialist

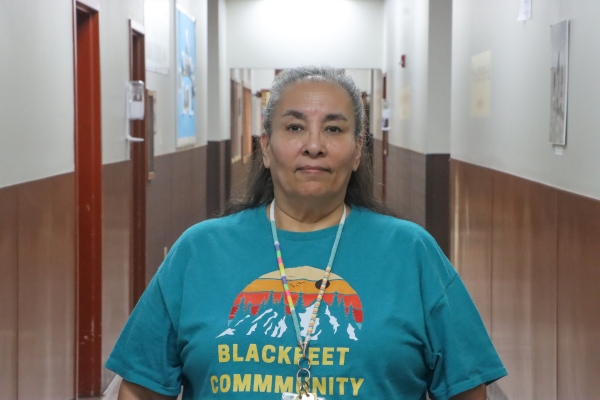

Ali Smith

Admissions Director

Email: alismith@bfcc.edu

Call: 406-338-5421 ext:2243

Cell: 406-845-4081

Fax: 406-338-3776

My role is directing the admission department at Blackfeet Community College. I ensure that every student's journey at BCC starts off on the right foot. The educational journey begins with the application process, which I oversee. I ensure that all required documents are received, answer any questions about choosing BFCC, and offer acceptance letters. I also guide students through the next steps in the registration process. As a point of contact, I am available to assist with any questions while students are enrolled at the college or interested in starting. I can be found in the community, at college fairs, and at various events where I can promote Blackfeet Community College and strive to reach out to the community and beyond. I also promote and advertise to prospective students via radio, TV, internet, newspaper, and in person. Additionally, I host annual open-house events. My door is always open, and I strive to make your experience at Blackfeet Community College wholesome, equitable, and resourceful.

Ali Smith was awarded the Admissions Professional of the Year MPSEOC Montana Colleges 2020

All-Star Teamwork Award MPSEOC Montana Colleges 2022

Joshlynn Snow

Dual Enrollment and Transfer Coordinator

Email: joshlynn.s@bfcc.edu

Call: 406-338-5441 Ext. 2267

Fax: 406-338-3776

As the Dual Enrollment and Transfer Coordinator at Blackfeet Community College, I am dedicated to supporting students through every step of their academic journey. I work closely with dual enrollment and transfer students to ensure a smooth transition into college life, providing guidance on admissions requirements, course selection, and student services.

My role involves coordinating the admissions process for incoming students, ensuring all required documentation is in place, and helping them navigate the necessary steps to get started at BCC. I also track and manage the progress of dual enrollment and transfer students to help them stay informed and on track. In addition to student support, I am actively involved in community outreach, promoting the college and its offerings at local events, and serving as a bridge between BCC and the broader community. Located in the admissions foyer, my office is one of the first stops for visitors, and I strive to create a welcoming environment where every student feels supported and informed from the moment they arrive.

Sequoia Reevis

Enrollment Specialist

Email: sequoia.r@bfcc.edu

Call: 406-338-5421 ext:2232

Fax: 406-338-3776

Registrar

Helen Horn

Registrar

Sandi Running Crane

Registrar Assistant

Financial Aid

Desiree Brown-Lopez

Interim Financial Aid Director

Vacant

Financial Aid Specialist

Fern Shootsfirst

Interim Student Accounts

Desiree Brown-Lopez

Interim Financial Aid Director

Email: desiree.bl@bfcc.edu

Call: 406-338-5421 Ext. 2246

Don't hesitate to get in touch with me for information, to check if your student file is complete, to set up FAFSA appointments & FAFSA assistance, work-study applications, work-study human resource forms, timesheets; verification of FAFSA info, financial aid paperwork, educational planner, etc., scholarship listings or Facebook posts, assistance getting tax transcripts, student verification paperwork, and helping with the FSA ID.

Consumer Information

The Title IV regulations require a college to publish and distribute consumer information to staff and students in a published format, such as a catalog, policy and procedure manual, handbooks, brochures, and other areas.

The following information is readily available to students in the student handbook, campus catalog, brochures, on campus, in electronic format, and other published formats, on the web, email, or in PDF upon request. Students can always find the information they need to understand the financial aid satisfactory academic progress standards online, in the catalog, or by request.

Financial Aid Satisfactory Academic Progress Standard

Satisfactory Academic Progress (SAP)

Federal and state regulations governing student financial assistance require that a college develop standards to measure academic progress toward a degree. Students applying for financial aid will be monitored for Satisfactory Academic Progress (SAP), whether or not financial aid was used for or received during any academic period in which the student was previously enrolled.

It's important to note that students will only be eligible for financial assistance if they meet the academic progress requirements. The Financial Aid Office monitors SAP at the end of each term and the end of the program period. Students must meet the minimum standards for SAP by the end of any given enrollment period at BFCC to maintain financial aid eligibility.

There are three criteria used to measure satisfactory academic progress:

- Cumulative grade point average (qualitative)

- Credit hour completion (quantitative)

- Program progression, aka Pace of Progression

The Financial Aid Office is a crucial support system in students' academic journey. They diligently monitor the student’s Satisfactory Academic Progress (SAP) at the end of each term and program period. Their unwavering support is vital as the students strive to meet the minimum standards for SAP by the end of any given enrollment period at BFCC to maintain financial aid eligibility. Students can be assured that the Financial Aid Office will help them navigate these standards.

There are three criteria used to measure satisfactory academic progress:

- Cumulative grade point average (qualitative)

- Credit hour completion (quantitative)

- Program Progression

Drop/Adds/WITHDRAWALS

This is a specific timeframe at the beginning of a semester when students can add or drop classes without penalty to their financial aid package, usually within the first few weeks of classes; "withdrawal" refers to dropping a class after the drop/add period has ended. This can significantly impact their financial aid eligibility and may require them to repay a portion of their aid if they drop below half-time enrollment.

- Drop/Add Period: Students can add or drop classes during this time without affecting their financial aid award. If they drop courses during this period, their aid may be adjusted based on the remaining credit hours they are enrolled in.

- Withdrawal Period: Once the drop/add period ends, dropping a class is considered a withdrawal.

- Withdrawing from classes after the deadline can result in having to repay a portion of their financial aid, particularly if they drop below half-time enrollment.

- Half-time enrollment: Most financial aid programs require students to maintain at least half-time or fifty percent enrollment to be eligible for aid. BFCC requires students to be enrolled fifty percent or more for aid.

Return of Title IV Funds: Students who withdraw from classes after the drop/add period may need to return a portion of their federal financial aid based on the "Return of Title IV Funds" policy.

Official Withdrawal

The student is officially considered to have withdrawn when the date the student provided is an official notification of intent to withdraw, in writing or orally, or the day the student began the withdrawal process with a counselor. A student can rescind this notification in writing to the Registrar and continue the program. If the student subsequently drops, the student’s withdrawal date is the original date of notification of intent to withdraw.

Official withdrawal dates and deadlines are specified in the approved BFCC Academic Calendar, which can be found in the catalog or online. However, the dates are subject to change without notice.

A student may withdraw from BFCC from the first class day to the official last day to withdraw as indicated in the BFCC Academic Calendar. The official last day to total withdrawal is approximately two weeks before the first day of final examinations for fall or spring terms.

Unofficial Withdrawal

An unofficial withdrawal means a student stopped attending classes without formally withdrawing, which results in the need to return a portion or all of their financial aid received during that term, as they are only considered to have "earned" the aid up to the date of their last documented attendance, and any excess must be repaid to the funding source; essentially, the student may only keep the financial aid they used for the time they were actively enrolled in classes.

Unofficial withdrawals encompass all other withdrawals where official notification is not provided. When a student does not officially withdraw and subsequently fails to earn a passing grade in at least one course offered over an entire period, the college must assume that the student has unofficially withdrawn for Title IV and HEA purposes unless the college can document that the student completed the enrollment period. Some essential points are:

Return of Title IV Funds Calculation: When a student unofficially withdraws, the college must calculate how much financial aid needs to be returned based on the withdrawal date, usually established by the last date of documented attendance in a class.

Impact on different aid types: This applies to all kinds of federal financial aid, including Pell Grants and work-study, and can also impact college assistance depending on separate policies.

Factors affecting the amount owed: The percentage of the term completed at the time of unofficial withdrawal determines how much financial aid the student can keep.

Responsibility to notify the college: Even if students do not formally withdraw, they are still responsible for informing the financial aid office if they stop attending classes to avoid penalties for an unofficial withdrawal.

An unofficial withdrawal can occur:

Not attending classes without formally withdrawing: The most common way is for a student to stop showing up to class without officially notifying the school.

Receiving failing grades in all classes: If a student earns failing grades in all their courses, this can be considered an unofficial withdrawal.

What students can do when they are considering withdrawing:

Contact the financial aid office: Students should try to officially withdraw from their classes through the proper channels to avoid the consequences of an unofficial withdrawal.

Understand the withdrawal deadlines: The college has deadlines for withdrawing from classes without penalty. Students should be aware of these dates, which are posted in the catalog, the registrar’s office, and the campus calendar.

Discuss the situation with an advisor: If students face circumstances that may require withdrawal, speak with their assigned academic advisor to explore options and potential impacts on their financial aid.

Grade Point Average (GPA)

BFCC requires a minimum cumulative GPA of 2.0 and a completion rate of at least 67% of attempted credit hours to maintain satisfactory academic progress (SAP). Students must also complete at least 67% of the credits they try to remain eligible for financial aid.

SAP requirements:

GPA: To maintain satisfactory academic progress, a student typically needs to maintain a minimum cumulative GPA of 2.0 (a "C" average) on a 4.0 scale

Credit Completion Rate: Students must complete at least 67% of attempted credit hours.

- Pace of progression: Students must complete a degree program within 150% of the expected timeframe, meaning they can attempt no more than 150% of the total credit hours needed for their degree to remain eligible for financial aid

Warning and probation status:

Students who fall below the SAP requirements may be placed on academic warning or probation, which could result in suspension from financial aid. This could potentially impact their eligibility for financial assistance for the current term or academic year.

Appealing to the Financial Aid Committee on Academic Standing

Students can submit a formal appeal application to the financial aid office to appeal a suspension of financial assistance. A letter explaining the circumstances that prevented them from meeting Satisfactory Academic Progress (SAP) requirements and how they will improve their academic performance should be included. Students need to provide third-party documentation to support their statements in their letter of appeal.

Some examples of circumstances that may be considered for an appeal include:

- Death or severe illness of a family member

- Involuntary job transfer

- Military deployment

- Medical emergencies

- Severe personal or family problems

- Financial or personal catastrophe

If the appeal is approved, there might be additional requirements to abide by. The student will then be placed on financial aid probation and granted an additional semester to finish the semester with all credits attempted with a grade of C or better. They will also be notified that they may need to improve their academic performance, change their study habits, or meet with a tutor, counselor, or mental health counselor.

Non-passing grades are figured into satisfactory academic progress in the following ways:

Failure (F): F is typically included in calculating attempted credit hours when determining satisfactory academic progress (SAP), but it is not counted as earned credits. Therefore, it negatively impacts a student's GPA and overall completion pace, which can prevent a student from maintaining satisfactory academic progress.

Federal regulations permit students to retake a failed course and receive financial aid for that repeat attempt. They can retake the course and still be eligible for financial assistance to cover the cost of that repeated class as long as they meet their college's Satisfactory Academic Progress (SAP) standards. If a student fails a class and repeats it, the original failing grade will remain on their transcript, but the new grade earned when retaking the class will replace the failing grade in their GPA calculation.

Incomplete (INC) or Withdrawal (W): This is not calculated in a student’s GPA but counted towards a student’s attempted coursework for the semester. If the course is retaken, only the new grade will be calculated in the student’s cumulative GPA, but both attempts will be counted towards a student’s cumulative attempted coursework.

Repeated (*R): If a course is repeated, the original course will be marked “*R” on the student's transcript when the student passes the repeated course. The original attempt will count towards a student’s cumulative attempted coursework but not their GPA. Students must maintain satisfactory academic progress to remain eligible for financial aid even when repeating a course.Students may enroll in any incomplete, withdrawn, or failed course the following term. Students dismissed from the program may re-apply following the standard admissions process but are not guaranteed readmission.

Repeat Grades (D grade or better): If a student chooses to retake a previously enrolled course to obtain a better grade, that course can be counted for the enrollment period. According to federal regulations, students can only receive Title IV Aid (federal financial aid) for any previously passed course once. This means that once a student passes a course, financial aid will only pay for the student to take that course one more time, regardless of whether they pass or fail it the second time when a student enrolls in a previously repeated and passed course for a third time. In that case, the course will not count towards the student’s overall enrollment for federal financial aid purposes, and the student will not receive federal aid to pay for this course.

Return of Title IV (R2T4), Higher Education Act (HEA) Policy

The Return of Title IV (R2T4) policy is a set of regulations that govern the process colleges follow when a student who receives Title IV funds stops attending school. The R2T4 policy applies to the following federal financial aid programs at BFCC:

- Federal Pell Grants

- Federal SEOG

The R2T4 policy determines if a student is eligible for the full Title IV funds they were initially scheduled to receive. The calculation is based on the proportion of the payment period that the student completed. The school must perform the R2T4 calculation using the student's attendance, withdrawal date, and the Title IV disbursed aid forms.

The outcome of the R2T4 calculation can be one of the following:

Funds must be returned: If the amount disbursed to the student exceeds the amount earned, the school must return the unearned funds.

- The student is eligible for a post-withdrawal disbursement (PWD): If the amount disbursed to the student is less than the amount they earned, the student may be eligible for a PWD.

- No funds need to be returned: If the student's scheduled attendance exceeds 60% of the enrollment period, they are considered to have earned 100% of the federal funds.

Return of Title IV Policy

The Return of Title IV (R2T4) policy requires that students and schools return unearned federal financial aid funds when a student withdraws from school before completing 60% of the term:

- When the R2T4 policy applies: When a student withdraws, drops out, fails a class, or is expelled

- How the amount to return is calculated: The percentage of the term completed is calculated by dividing the number of days completed by the total number of days in the term.

- What funds are included: The R2T4 policy applies to federal grants, loans, and work-study programs.

- Who is responsible for returning funds: The school returns the unearned funds to the student's account within 45 days of the withdrawal notice.

Pace of Progression

The 150% rule for Satisfactory Academic Progress (SAP) is a time-based metric that requires students to complete their degree program within 150% of the maximum timeframe. The pace of progression is calculated by dividing the number of credits a student has earned by the number of credits they have attempted. To meet the pace of progression requirement for a two-year and four-year program, students must earn at least 67% of the credits they attempt each semester.

Here are some other things to know about the 150% rule:

- The 150% rule is based on the length of the student's program. For example, a bachelor's degree program usually takes four years, so the 150% timeframe is six years.

- Developmental and ESL courses are not included in the calculation.

- All attempted credits are counted, regardless of whether the student received financial aid for those terms.

- Students not on track to graduate within the 150% timeframe will lose eligibility for federal student aid.

- Students on financial aid suspension can appeal to the Committee on Academic Standing. The student will be placed on financial aid probation for one semester if the appeal is granted.

R2T4 Formula Calculation

The Return of Title IV (R2T4) calculation determines the percentage of Title IV aid a student earned and the amount of unearned Title IV aid they owe:

- Percentage of Title IV aid earned: Divide the number of days attended by the total number of days in the enrollment period.

- Amount of unearned Title IV aid: Multiply the percentage of unearned Title IV aid by the total amount disbursed Title IV aid.

Other factors to consider when calculating R2T4:

- Inadvertent overpayments: If a college disburses funds to a student who is no longer enrolled, the funds are considered aid that could have been disbursed and are included in the R2T4 calculation.

- Waivers: If a school treats a waiver as a payment for tuition and fees, the total amount of those charges must be included in the R2T4 calculation. If the student is not assessed the total charges, only the actual charges are included.

REFUNDS and CANCELLATIONS

Pell Grants can be refunded if there is a remaining balance after college expenses are paid or if a student declines, reduces, or returns funds:

- Refunds: After the fall and spring semesters, schools may issue a refund for any remaining Pell Grant balance. Students can receive their refund as a check to be picked up the student on the posted dates. Refunds are typically issued within 14 days of the funds being posted to the student's account. The dates posted are the earliest students can receive any funds. They will not receive the funds when they appear in the student’s account because they can be posted 5-7 days before issuing refunds.

- Cancellations: Students can decline, reduce, or return Pell Grant funds during the academic year to preserve eligibility for future semesters.

- Funding cancellation: Five years after the data submission deadline for a specific award year, the Pell Grant funding for that year is no longer accessible

Pell Grant refunds:

- Unused funds: If a student's Pell Grant exceeds their total college expenses, the remaining amount will be refunded to them.

- Student decision: Students can also decline or return a part of their Pell Grant if they do not need the total amount.

- Contacting the school: Students must initiate receiving a Pell Grant refund by contacting their financial aid office.

Here are some examples of students who may have to repay all or part of a federal grant:

- They withdrew early from the program for which the grant was given.

- Their enrollment status changed in a way that reduced their eligibility for their grant (if they switched from full-time to part-time, the grant amount would be reduced).

- They received outside scholarships or grants that reduced their need for federal student aid.

- They received Federal Pell Grant funds from more than one school at a time.

Drop/Adds/WITHDRAWALS

All students dropping/adding or withdrawing must visit the Office of Financial Aid to discuss the impact of withdrawal or drop/add on their scholarships, federal financial aid, or any other form of financial aid. Once the student receives federal financial assistance, the Student Financial Aid office will need verification of their last class attendance or activity for each course from each one of their instructors.

Colleges Responsibilities

The following are the College’s responsibilities regarding Title IV HEA funds:

- The College will provide students with information about this policy.

- Financial Aid will identify students affected by this policy and complete the Return of Title IV funds calculation.

- Any Title IV HEA funds required will be returned to the correct Title IV programs within 45 calendar days of the date the official notice of withdrawal was provided.

- If less Title IV aid has been disbursed than the student has earned, a post-withdrawal disbursement will be calculated and must be offered.

- The college will always return all excess funds, including those the Return of Title IV calculation identifies as the student’s responsibility to return.

Student Financial Aid Rights and Responsibilities

- ·Any withdrawal notification should be in writing and sent to the Registrar’s Office.

- A student may rescind their notification of intent to withdraw. Submissions of intent to revoke a withdrawal notice must be filed in writing with the Registrar’s Office.

- To withdraw or rescind to withdraw, these notifications must be sent to the Registrar’s Office.

- The student must repay any funds to BFCC that were disbursed to the student in which the student was determined to be ineligible via the R2T4 calculation.

Academic Program Information

Students will not be eligible for financial aid for courses that do not apply to their specific academic program. To receive assistance, they must be enrolled in at least six credit hours per term.

Second Associates Degree

When applying for financial aid for a second associate's degree after reapplying for admission to the College, the student must state intentions to earn a second associate's degree. An academic advisor must assist the student in determining the courses they will need to complete a new associate's degree, and an education planner must be completed and given to the financial aid office.

Financial aid will only be given for the courses needed to complete the new associate’s degree, provided the student has not exceeded the maximum credits for that program. Declaring another associate's degree does not reset the maximum timeframe.

Financial Aid Degree Audit

The financial aid office will conduct a degree audit after accepting incoming students to clarify their eligibility for federal aid. The audit clarifies which courses are necessary to complete their degree and the number of semesters it takes to complete the courses with the academic department to which they have applied.

Students will only get financial aid for the courses needed to complete them in the required time frame, and cumulative career credits cannot exceed 150% of total credits. According to regulations, students are not eligible to receive Title IV assistance (Federal Student Aid) aid for coursework that will not count toward completing that student’s degree program requirements. BFCC can only disburse federal financial aid funds toward classes required on a student’s degree audit in compliance with the regulations.

This means that classes beyond the degree completion requirements are not eligible for federal or state financial aid. Students should expect their federal financial assistance to be prorated or deleted depending on the courses they enroll in each term.

The system will verify that the first 12 units count toward the degree requirements. Only courses that satisfy a degree requirement will result in eligible payment. Students who have been approved to substitute a course must submit the Waive-Sub Forms to Enrollment Services, preferably during Week 11, before the start of the term, to receive eligible funding on schedule.

Students approved for a Lite term must register only for courses that satisfy degree requirements.

Students seeking another undergraduate degree are not eligible for financial aid as baccalaureate students. Although federal financial aid eligibility may be limited or eliminated, students can pursue alternative educational funding sources.

Contact Us!

Follow us on social media!

-

admissions@bfcc.edu

-

fin_aid@bfcc.edu

-

registrar@bfcc.edu

- Fax Number 406-338-3376

- BFCC Enrollment Services: https://www.facebook.com/BFCCEnrollmentServices/

Enrollment Services Mission & Goals

Mission

Mission

Enrollment Management Services serves as a resource for students to have college questions addressed in a single location. It strives to facilitate the college's institutional mission by providing superior customer service in a student-friendly environment. To use data & analytics to engage with students in meaningful ways.

Goals

Goals

At BFCC, we maintain a student-centered environment while helping you navigate enrollment processes. We aim to provide you with the required service or refer you to the office that best meets your needs.

We aim to transform your student experience, empowering you to achieve your academic and career dreams through education. Your success will benefit you and positively impact our community, region, and state.

Vision

Vision

Our vision is enrollment services, a place to receive information and data and provide prospective student assistance in one central location where all incoming students are empowered to reach their personal, academic, and career goals.